Sage vs Xero

A Quick Comparison of the Differences Between Sage and Xero

What are the Differences between Sage and Xero?

Sage vs Xero

Sage and Xero are both market leading accounting software solutions for their respective target markets in the UK. Xero is predominately used by smaller businesses and the self-employed, whilst Sage cover’s a wider spectrum of business sizes from small businesses to SMB’s and medium sized businesses.

When you compare Sage with Xero there are many differences in features between the two accounts systems, depending on the size of your business and industry type.

Xero is a good fit for smaller businesses, sole traders and the self-employed, whilst Sage offers four cloud accounting software solutions in the UK covering small businesses, SMB’s, medium sized businesses and larger companies.

Xero have three accounting software plans (Starter, Standard & Premium), their cloud finance software is a good choice for managing core accounting requirements for small businesses, start-ups and the self-employed.

Sage have four market leading Cloud finance solutions in the UK:

- Sage Accounting is used by small businesses and the self-employed (previously known as Sage One).

- Sage 50 is targeted to more established small businesses.

- Sage 200 is an ERP and finance management solution for SME’s, available in two versions Standard and Professional.

- Sage Intacct is targeted towards small to medium sized businesses and departments of larger organisations.

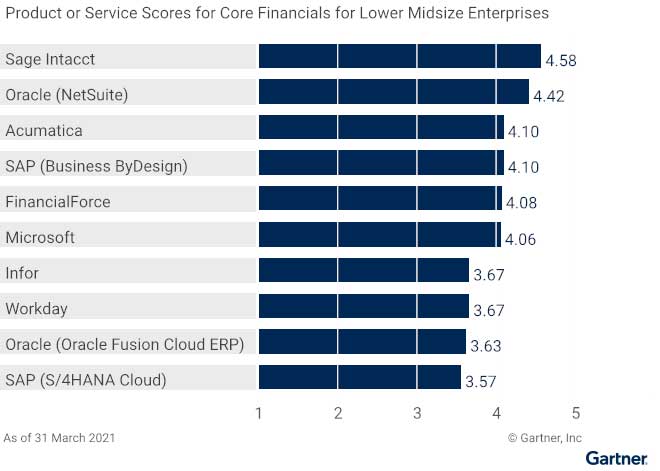

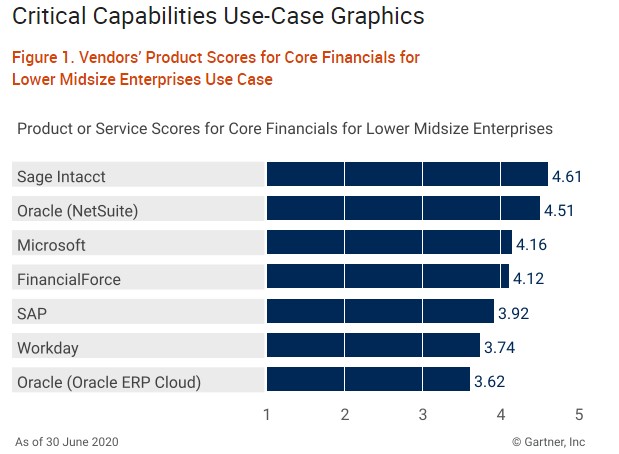

Sage Intacct Received the Highest Score for Core Financials for the 5th year Running from Gartner. It also received the highest #1 score in Customer Satisfaction Ratings from G2.

Related Information

Download the guide – Sage 50 v Sage 200

Download the Sage 50 vs Sage Intacct comparison guide

Sage Intacct vs Xero

Download the Sage 50 Brochure in PDF Format

Download the NEW Sage 200 Brochure in PDF format

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

What is Xero Accounting Software?

Xero is a leading Cloud-based accounting solution for small businesses and the self-employed. It was founded in New Zealand in 2006 and has over 3 Million subscribers. Xero’s products are based on the software as a service (SaaS) model and sold by subscription.

The headquarters for Xero is based in Wellington, New Zealand and they are listed on the Australian Securities exchange.

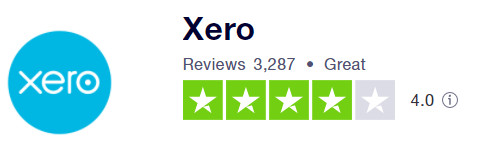

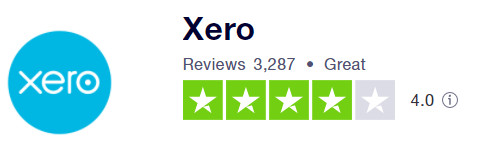

See Trustpilot reviews for Xero.

Xero - Cloud Accounting Basics

What is Sage?

Sage was founded in 1981 and today the Sage Group PLC is a global technology leader for Cloud accounts software that provides small and medium sized businesses with the visibility, flexibility and efficiency to manage, accounts, finances, operations and people.

The Sage Group PLC is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

Sage is the third-largest supplier of enterprise resource planning (ERP) software and the largest supplier of accounts software to small businesses, the company has over 6.2 Million customers worldwide and over 12,000 employees, and has their headquarters in Newcastle Upon Tyne, UK.

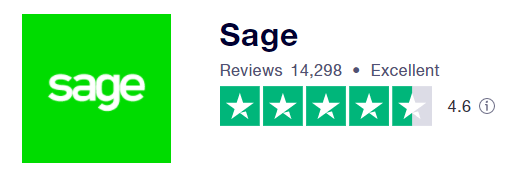

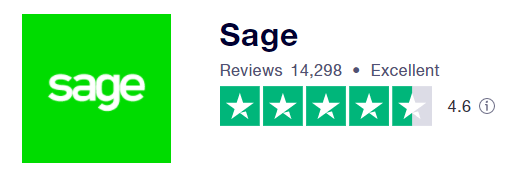

See Trustpilot reviews for Sage.

Sage Intacct - What is it?

How Can Xero and Sage Help Manage Your Business Finances and Accounts?

Many people ask the question is Sage better than Xero, or is Xero better, at the end of the day many companies will choose a finance management solution that is best suited to manage your accounting requirements, this can vary considerably for every business and industry.

The entry level products for both Sage and Xero offer pretty much the same features and benefits for your business, and they have similar monthly subscription costs.

Typically, most accounting software systems have the core following features to help you manage your business finances.

- General ledger

- Accounts payable

- Accounts receivable

- Sales orders

- Invoicing

- Purchase orders

- Inventory management

- Cash Book and bank reconciliation

- Online VAT submissions and MTD

When your business needs to manage and automate more complex accounting processes then the differences between Sage and Xero become more apparent, as more established smaller companies, SMB’s, medium sized businesses and large companies need a more configurable, flexible and scalable finance management system, usually requiring additional accounting modules.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

Comparison of Xero vs Sage

Both Sage and Xero are well known in providing software for small businesses, start-ups and the self-employed. Both Sage Accounting Plus and Xero Premium target this small business marketplace, they are both easy to use, intuitive, and they work in the Cloud.

Xero and Sage Accounting have similar features, benefits, functionality and are very reasonably priced, yet they offer basic accounting functionality and do not manage certain complex processes, such as manufacturing, advanced project accounting, bill of materials (BOM) and ERP.

One of the best resources available to see the feedback from customers is from Trustpilot, this provides reviews from thousands of end users from the small business market.

Xero Premium Core Features

- Send invoices and quotes

- Enter bills

- Reconcile bank transactions

- Submit VAT returns to HMRC

- Capture bills and receipts with Hubdoc

- Automatic CIS calculations and reports

- Bulk reconcile transactions

- Use multiple currencies

- Short-term cash flow and business snapshot

For more information on Premium features, further information.

Optional add-ons for Xero

- Payroll

- Claim expenses

- Track projects

- Submit CIS returns

- Pay with Wise

- Analytics Plus

There are many third-party add-ons and apps for Xero, this enables you to further enhance the functionality of the core accounts system, further information.

Xero Accounting Overview

Sage Accounting Plus Features

Sage Accounting is a cloud-based accounts solution targeted towards small businesses, start-ups and the self-employed in the UK. Sage Accounting was previously known as Sage One and offers basic accounting, invoice management, cash flow forecast, compliance management and expense management.

There are three different versions to choose from, Start, Standard and Plus. All three versions contain the same core features such as create and send invoices, track what you are owed, automatic bank reconciliation and calculate and submit VAT online.

Features available in the Plus Version of Sage

- Create and send invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Supports unlimited users

- Manage and submit CIS

- Run reports

- Send quotes and estimates

- Access data through mobile devices

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry,

- Invoice in multiple currencies

- Manage inventory

- Making Tax Digital (MTB) compliant

There are plenty of optional add-ons, such as Payroll, as well as additional apps from the Sage Marketplace.

Sage Business Cloud Accounting (UK) - Introduction

What are the Differences between Sage 50 and Xero?

Sage 50 is a very well-established accounts product which has been tried and tested by hundreds of thousands of users in the UK. Xero is also a well-established company, and it has grown rapidly since its launch in 2006 and offers a good Cloud accounts platform for small businesses.

There are differences between Sage 50 Accounts and Xero, both solutions offer good basic core accounting features and are reasonably priced and offer great value.

Sage 50 Accounting Software

Sage 50 is the next product up from Sage Accounting and has been a market leader in the UK for many years with over 400,000 businesses using the software to manage their finances.

There are two versions of Sage 50, Standard and Professional, the Professional version has the most features, the functionality can be further extended as it has a large number of additional add-ons and apps available from the Sage Marketplace.

Sage 50 Customer Success Case Study – DPR Motorsports

British motorsports company DPR shows its winning streak with Sage 50. DPR has built thirty of the top-performing cars in the Caterham Motorsport Championships. Operations are split between the workshop and the main UK racetracks.

Thanks in part to Sage 50, DPR is excelling. The company has developed a winning formula for business success based on a deep understanding of the customer and a firm commitment to team excellence.

DPR Motorsports uses Sage 50 to keep a close eye on its business both on and off the race track, with powerful stock and inventory management updated in real-time from any race location, plus simple but effective bank reconciliation that provides improved financial transaction accuracy.

“We could not run our business without Sage, efficiently or otherwise.”

“When customers ask you a question, you’ve got to be able to provide the answers. Recording the customer data in Sage gives you the ability to get the information out accurately.”

Derrick Rowe, CFO, DPR Motorsports

Sage 50 Customer Success Case Study – DPR Motorsports

Sage 50 has in-depth stock management and reporting capabilities, it is a popular choice for small companies and also has a large following of SMB’s, just some of the features and benefits of the Professional version includes:

- Manage cash flow, income, expenses and payments

- Create professional personalised invoices and quotes

- Access finance data 24/7 via an internet connection

- Set up contacts with individual pricing and discounts

- Create sales and purchase orders

- Set up invoices, transactions, sales and purchase orders to recur

- Automatic bank reconciliation (including foreign currencies)

- Calculate and submit VAT to HMRC

- Add extra users (additional fees apply)

- Manage and submit CIS to HMRC (additional fees apply)

- Create and run bespoke reports

- Sage 50 Payroll Integration

- CRM Integration with Sage CRM

- Advanced stock management

- Manage multiple companies, departments and budgets incl. management reports

- Invoice & trade in foreign currencies

- MTD compliant

- Pay now button with integration with Stripe, PayPal

- GoCardless integration

Sage 50 Accounts

Sage 200 versus Xero - What are the Differences?

The Sage 200 system is the next product up from Sage 50 and caters for SMB’s and medium sized businesses. The Sage 200 system is more expensive than Xero, however it is full of advanced features and can manage complex accounting requirements and processes. There are two versions of 200 to choose from Standard and Professional, see comparison.

Xero and Sage 200 are both market leaders in their retrospective target markets, however 200 is a business finance management and ERP solution that follows a modular approach to manage complex financial requirements, you can add modules such as BOM, Manufacturing, Project Accounting, Supply Chain, and more.

Key Features of Sage 200

- Advanced financial management

- Highly customisable, configurable and scalable

- Superior database performance, uses Microsoft SQL

- Four key nominal ledgers in 200 Financials

- Manage complex business processes

- 3 tier nominal structure

- Supply chain management – Commercials

- Microsoft Office 365 integration

- Advanced multicurrency functionality

- Control financial periods

- Integration with CRM

- Powerful reporting and dashboards

- Project management module

- Batch/Serial number processing

- Control financial periods

- Multiple warehouses

- Manufacturing module

- Bill of materials

- Ideal for medium sized companies or fast-growing businesses

- Sales, marketing and service

- Up to 20 analysis codes for additional reporting purposes

- Up to 9 million transactions

What are the Differences Between Sage Intacct and Xero?

The Sage Intacct Cloud solution is one of the most versatile and feature rich Cloud finance management solutions available, primarily targeted towards medium sized business, where as Xero is targeted to smaller businesses.

Medium sized businesses tend to have more complex requirements and Intacct tackles these requirements with its modular approach. Both Xero and Intacct are good at what they do for their respective target markets.

Sage Intacct has won many awards and has been the the best core financials software for 5 years running, for more information on Sage Intacct and its features.

How Much Does Sage and Xero Cost?

The cost and pricing for Sage depends on which product you choose to go with, as they have four Cloud finance and accounts solutions for the UK market.

Sage Accounting is the least expensive, as it offers basic accounting features for small businesses. More advanced accounts packages such as 50, 200 and Intacct have different pricing plans.

Xero has three pricing plans for their Cloud accounts system, Starter, Standard and Premium. Both Xero and Sage have optional extra’s for their products, these could be extra modules, apps or integration with software such as Payroll.

Xero Pricing and Costs

For up to date costs and more details go to Xero pricing plans.

- Starter starts at £10 per month

- Standard starts from £24 per month

- Premium starts from £30 per month

There are a number of optional extras such as Payroll that increases the price.

Sage Accounting Costs and Pricing

The closest product to Xero from the Sage product range is Sage Accounting, see latest costs, pricing plans, and deals, further information.

- Start – starts from £12 per month

- Standard – starts from £24 per month

- Sage Accounting Plus – starts from ££30 per month

Sage Accounting has a number of additional add on’s and apps that you can add to the core system.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

Sage 50 Costs and Pricing

The cost of purchasing 50 depends on the number of users that you require as well as the number of companies (Standard has up to 2 companies, and Professional has the option of unlimited companies) you want to manage the accounts for, prices do change so please call us for the latest prices.

Sage 50 Standard Pricing – For Two Companies

- 1 Core User £65 per month

- 2 Core Users £77 per month

Professional Pricing – For Ten Companies

- 1 Core User £132 per month

- 5 Core Users £139.50 per month

- 10 Core Users £147 per month

- 20 Core Users £157 per month

Sage 200 Standard Costs

Sage 200 is aimed at SMB’s and medium sized businesses and is a comprehensive finance management and ERP solution that can manage more complex accounting processes.

There are two versions of Sage 200, Standard and Professional. The Standard version comes with 3 users when you subscribe to the software.

The Standard version of 200 is only available online through a monthly subscription plan (SaaS). Costs start from £283.50 per month for a 12-month contract, and the software is hosted by Sage, further information on pricing.

Standard Prices per Month

- Sage 200 Standard base unit* £283.50 per month (includes 3 users)

- Additional users £15.75 per month

- Additional companies £31.50 each per month

Prices do change, so please call us for the latest prices and costs.

Intacct Costs and Pricing

The Sage Intacct product is marketed towards medium sized business and larger companies, Sage has a policy to not publish Intacct prices online, so please call us for a quote.

What are the Benefits of Using Sage or Xero in the Cloud?

Both Sage and Xero aim to be global leaders for Cloud accounting solutions, as there are many benefits of hosting your accounts in the Cloud.

One of the advantages of using finance software in Cloud is that both companies use SaaS (Software as a Service) pricing models, where you pay for the software on a monthly subscription fee, because the accounts data is hosted in the Cloud means that you do not need to invest in expensive servers or data backup hardware.

There is no clear winner between Sage and Xero as to who is better at hosting accounting software in the Cloud, both providers offer pretty much the same business benefits and adhere to strict hosting and security standards at their datacentres.

Benefits of Using Cloud Accounting Software

- See your current financial position in real time and at any time

- Finance and Accounts data is accessible 24/7

- All accounting information is in one place

- Work from anywhere with Internet connection

- Both Xero and Sage support access through mobile devices with a connection to the internet

- Spread the cost by paying monthly (SaaS)

- Frees up IT resources and reduces expensive IT overheads

- The software is constantly updated with new versions so you do not need to worry about applying software updates

- Real time dashboards and reporting enables you to monitor key performance indicators for your business

- Hosting Sage or Xero in the Cloud provides a very high level of security, the software is hosted on a secure server where you have protection against financial and accounting data loss

- No need to invest in expensive servers or data backup hardware

- Quickly give access to multiple users and set employee permissions

- Easily collaborate with your accountant and other users in your business

What are the Key Strengths of Xero and Sage?

Both Sage and Xero are well respected and proven Cloud financial solutions, and both have numerous key strengths and large customer bases.

Key Strengths of Sage

Sage has a number of key strengths for accounts software in the UK market, its products cover all the requirements of small businesses, SMB’s, medium sized businesses and larger companies.

Because Sage has four market leading Cloud solutions for various sized businesses and industry types, Sage Accounting, 50, Sage 200 and Intacct, there is always a solution to choose from that meets your finance management requirements.

Sage’s software is well designed, easy to use and intuitive, and can manage complex accounting processes and finance requirements. There are also a large number of applications and add-ons that you can add – available from Marketplace.

Another key strength of Sage versus Xero is its tight integration with other business applications and payment solutions, such as Microsoft Office, Payroll, Modulr, GoCardless, PayPal, Power BI, Salary and Supplier Payments, CRM integration plus many more.

Check out the latest Trustpilot reviews.

Key Strengths of Xero

Xero has seen an impressive growth in the number of subscribers over the last few years with over 2.7 Million Cloud subscribers. The Xero software is easy to use, intuitive, and offers core accounting features for small businesses at an affordable price.

The Xero accounts system is easy to learn and you are connected to your own advisor, it provides you with unlimited users. The system has a clean interface which gives you real time visibility of your financial position.

The software offers easy integration with a large number of third-party apps and plugins enabling your to further enhance the features and functionality of the core system.

Trustpilot feedback and reviews from customers are generally good, see the latest reviews and ratings.

Frequently Asked Questions

Xero is ideal for small business owners or sole traders who require basic accounting features to manage invoicing, cash flow management and bank reconciliation, whereas Sage’s products have more advanced accounting features and can be tailored around your business and is a better fit for small to medium sized businesses.

Contact AlphaLogix to Discuss Which Accounting System is Best for Your Business

Our experts will help you discover which Accounts and Finance Management software is best suited for your business based on your requirements, business size and industry type.

We will provide you with a free initial consultation call, and we can also provide you with a free demonstration on certain products.

Call us today on 0330 043 0140 to organise a demo or to speak with one of our experts, alternatively email us at info@alphalogix.co.uk. We will help you through every step of the selection process, implementation process, including training and support.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

Related Information