Sage 200 Tips – Hide Customers and Suppliers

14th December 2017

Sage 200 Additions – Mobile Sales Order App

14th February 2018The Fixed Assets module for Sage 200 is a useful feature that comes free with the Financials suite of modules. If you’re using Sage 200 Version 2016 or later then you can use this feature to manage your fixed assets, however you may not even be aware of it as the Fixed Asset module is located within the Nominal Ledger menu structure and is not immediately apparent.

Before the 2016 Version release of Sage 200, many users had been managing their fixed assets outside of Sage 200 using spreadsheets, but now you can create, maintain, depreciate and dispose of your fixed assets within Sage 200 and it is quite straight forward to do.

Sage 200 Fixed Assets – Create Your Asset

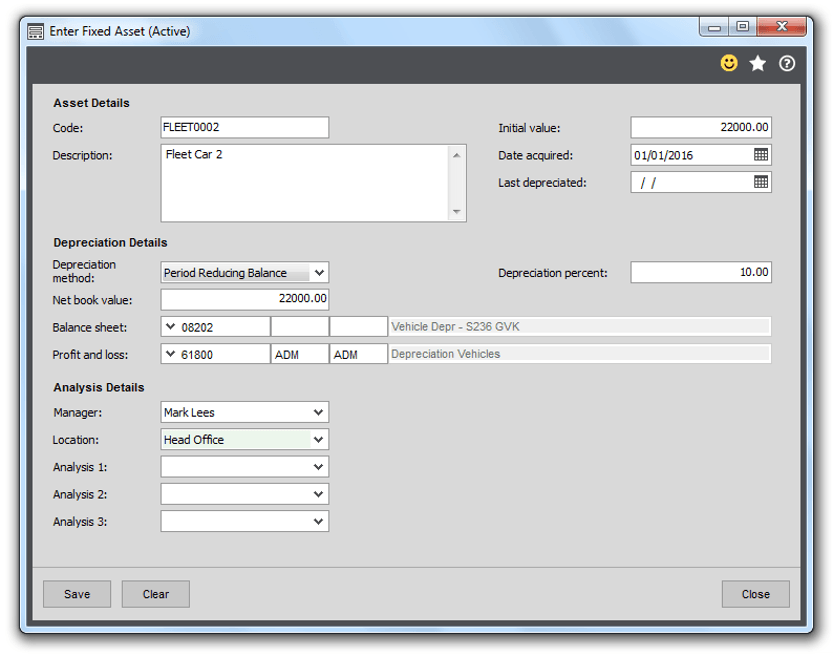

From the Nominal Ledger, select Fixed Assets > Enter New Asset and enter the details of the asset.

Choose the Depreciation method from the drop-down list. Depreciation can be measured periodically or annually, and the methods to choose from are Straight Line or Reducing Balance.

Period Straight Line – the asset utilisation will be spread evenly across time and depreciated over periods rather than years. The asset’s value is reduced by a percentage value based on the initial value, the residual value and the asset life span in periods with the value of depreciation remaining the same each time.

Annual Straight Line – the asset utilisation will be spread evenly across time and depreciated over years rather than periods. The asset’s value is reduced by a percentage value based on the initial value, the residual value and the asset life span in years with the value of depreciation remains the same each time.

Period Reducing Balance – use this if you expect an asset to wear out quickly and need to measure this in terms of periods rather than years. The asset’s value is reduced by a percentage of the Net Book Value which reflects the asset’s current worth every period until it is reduced to 0.

Annual Reducing Balance – use this if you expect an asset to wear out quickly and want to measure this in years. The asset’s value is reduced by a percentage of the Net Book Value which reflects the asset’s current worth every year until it is reduced to 0.

Choose your Balance Sheet and Profit & Loss nominal accounts for the postings that will be made. Analysis Codes can be attributed to the Fixed Asset too for reporting purposes.

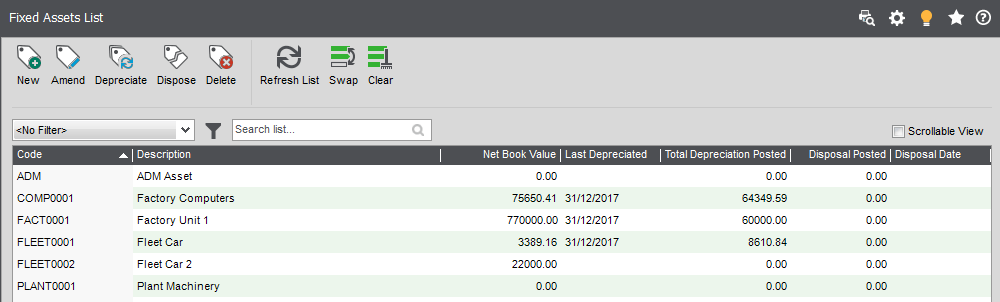

Your new Fixed Asset will appear in the Fixed Assets List View:

Sage 200 Fixed Assets – Depreciate Your Asset

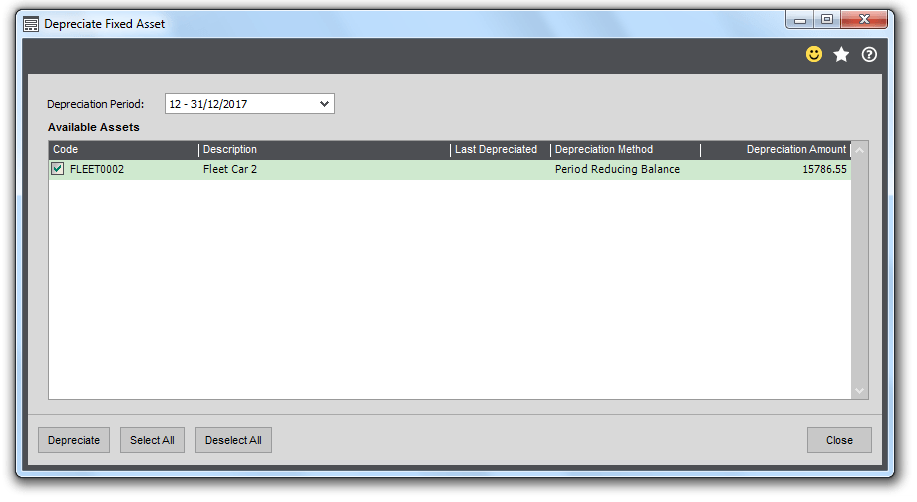

Depreciating your Fixed Assets is a manual process and depending on the depreciation method you have chosen can be a part of your month-end or year-end process. Select Depreciate from the menu and a form will open prompting you to choose a Depreciation Period.

The Period will default to the current period, but this can be changed using the drop-down list. The ‘Available Assets’ listed will depend upon the period that you have chosen, i.e. only those assets available to be depreciated will be displayed.

Tick the boxes of those assets you wish to depreciate and select Depreciate. Postings will be made to the nominal accounts that you have chosen and if you had selected a Period method then postings will be made for each of the periods between the most recent depreciation period and the period you have chosen.

Assets can also be disposed of in a similar manner, and once there is no residual value they can be deleted.

Keep an eye out for future blogs from the team at AlphaLogix!

Your Accounts System | Our Expertise | Let’s Talk…

Our team of Accredited Sage 200c Product Specialists have many years of experience and are here to help, from initial consultation through to: development, implementation, training and on-going support.

If you would like any further information or a demonstration of Sage 200c, please contact us:

Email: info@AlphaLogix.co.uk

Tel: 0845 259 3141

Kind Regards,

Richard Owens | Product Specialist