Sage vs QuickBooks

What are the differences between Sage and QuickBooks?

Sage vs QuickBooks

Sage and QuickBooks are both market leading accounting software solutions for their respective target markets in the UK. QuickBooks online is predominately used by smaller businesses and the self-employed, whilst Sage cover’s a wider spectrum of business sizes from small businesses to SMB’s and medium sized businesses.

When you compare Sage with QuickBooks there are many differences in features between the two accounts systems, depending on the size of your business and industry type.

QuickBooks online is a good fit for smaller businesses, sole traders and the self-employed, whilst Sage offers four cloud accounting software solutions in the UK covering small businesses, SMB’s, medium sized businesses and larger companies.

QuickBooks have three accounting software plans (Simple Start, Essentials & Plus), their cloud finance software is a good choice for managing core accounting requirements for small businesses, start-ups and the self-employed.

Sage have four market leading Cloud finance solutions in the UK:

- Sage Accounting is used by small businesses and the self-employed (previously known as Sage One).

- Sage 50 is targeted to more established small businesses.

- Sage 200 is an ERP and finance management solution for SME’s, available in two versions Standard and Professional.

- Sage Intacct is targeted towards small to medium sized businesses and departments of larger organisations.

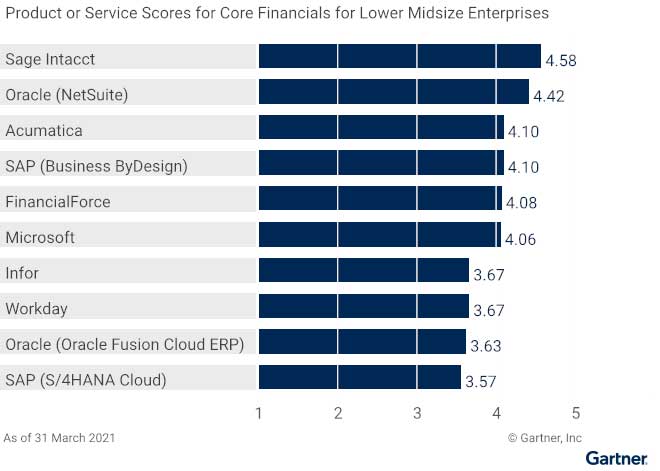

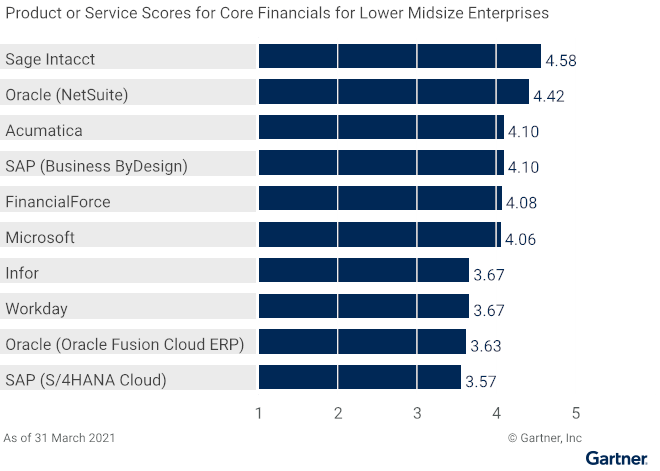

Sage Intacct Received the Highest Score for Core Financials for the 5th year Running from Gartner. It also received the highest #1 score in Customer Satisfaction Ratings from G2.

Related Information

Sage Intacct vs Quickbooks Comparison Whitepaper PDF Download

Sage Intacct vs QuickBooks

Download the guide – Sage 50 v Sage 200

Download the Sage 50 vs Sage Intacct comparison guide

Download the NEW Sage 200 Brochure in PDF format

The Fundamentals of Accounting Guide PDF

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

What Can Sage and QuickBooks Do for your Business?

There are plenty of benefits that both QuickBooks and Sage can bring to your business.

For smaller businesses, start-ups and the self-employed the software packages that Sage and Quickbooks market offer basic core accounting software features including invoicing, payroll, bank connections and reconciliation, cash flow forecasts, HMRC submissions, MTD compliant, VAT, expenses, time tracking, payment’s integration, and lot more.

QuickBooks typically focuses on smaller businesses in the UK, whilst Sage has a much broader Cloud accounting product range that can handle more complex accounting requirements for medium sized businesses and larger companies.

Both Sage and QuickBooks online Cloud accounting solutions will help you manage your business finances and accounts, including sales, orders, invoices, productivity, budgets, profits.

For larger SMB’s and medium sized businesses Sage offers a number of ERP and Finance Management systems that help with managing the whole business operations, these include Sage 200 and Sage Intacct.

Sage 50

What is Sage?

Sage is a market leading accounting software and ERP systems provider and was founded in 1981. Today the Sage Group PLC is a global technology leader for Cloud accounting software that provides small and medium sized businesses with the visibility, flexibility and efficiency to manage, accounts, finances, operations and people.

Sage is the third-largest supplier of Enterprise Resource Planning (ERP) software and the largest supplier to small businesses, the company has over 6.2 Million customers worldwide and over 12,000 employees, and has their headquarters in Newcastle Upon Tyne, UK.

The Sage Group PLC is based in the UK and has offices around the world, the company is listed on the London Stock exchange.

Trustpilot customer reviews for Sage.

Sage Intacct Received the Highest Score for the 5th year Running

Intacct received the highest score in Core Financials for Lower Midsize Enterprises Use Case in Gartner’s 2021 Critical Capabilities for Cloud Core Financial Management Suites for Midsize, Large, and Global Enterprises.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

What is QuickBooks?

QuickBooks is an accounting software package developed by Intuit and has been a market leader for financial software since the first version was launched in 1983.

Today QuickBooks mainly targets smaller companies in the UK with its QuickBooks online software. The company also targets larger smaller to medium sized businesses (SMB’s) with its Enterprise solutions.

Intuit’s headquarters are based in Mountain View, California and the company are listed on the Nasdaq stock market, Intuit has over 10,000 employees worldwide.

Trustpilot customer reviews for QuickBooks UK.

How to Navigate in QuickBooks

What are the Products from Sage and QuickBooks?

There are a number of Cloud accounting software products that both Sage and QuickBooks market in the UK.

QuickBooks Online Products

QuickBooks main Cloud accounting software is QuickBooks Online, which has three available versions, Simple Start, Essentials and Plus. QuickBooks online offers basic accounting software for small businesses, start-ups and freelancers.

If you are a sole trader not registered for VAT who need to prepare Self-Assessment, then QuickBooks Self Employed is available.

- QuickBooks Self-Employed – Simple core accounting features, the Self-Employed version helps sole traders & the self-employed to submit their Self-Assessment tax return forms.

- QuickBooks Simple Start – Simple Startis accounting software for single users that want income and expense tracking, reporting, invoicing, and mileage tracking.

- QuickBooks Essentials – Essentials does everything that Simple Start will doand adds the ability to manage bills and track time.

- QuickBooks Online Plus – Gives you the functionality of Simple Start and Essentials with the added ability to track inventory and track profitability by project, further information.

QuickBooks also markets their Enterprise software, but this is still only available on the desktop in the UK and not in the Cloud, check with QuickBooks for latest updates.

Overview of the Features of QuickBooks Online

Sage Business Cloud Accounting Products

Sage has a wide range of accounting and finance management software that can be used in the Cloud, they cover the whole spectrum of business sizes from small companies, SMB’s, medium sized businesses and larger corporates, the Sage products include:

- Sage Accounting –Cloud based software for small businesses, start-ups and the self-employed, available in 3 different versions, Start, Standard and Sage Accounting Plus, (formerly known as Sage One).

- Sage 50 – Finance and Accounting software for small businesses and SMB’s, available in two versions, Standard or Sage 50 Professional.

- Sage 200 – Business Finance Management and Accounting software for SMB’s and medium sized businesses, available in two versions Professional and Sage 200 Standard.

- Sage Intacct – powerful Cloud based Finance Management and Accounting system for larger SMB’s and medium sized businesses, Intacct is also used by larger companies.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

Intro to Sage Business Cloud Accounting

Comparison of Sage Accounting Vs Quickbooks Online

Both QuickBooks and Sage are market leaders for providing Cloud accounting software for smaller businesses, start-ups and the self-employed.

QuickBooks Online and Sage Accounting are the two solutions aimed at the small business market. They both offer basic core accounting functionality and have similar features, and are good value. Businesses pay a monthly subscription fee (SaaS) to use these Cloud accounting solutions.

QuickBooks Online Plus Features

- Manage income & expenses

- Send ‘pay-enabled’ invoices

- Connect your bank

- Forecast cash flow

- Snap & sort receipts

- Track mileage

- Create estimates & quotes

- Run customised reports

- Manage bills

- Multi Currencies

- Track stock

- Tax

- Prepare Self-Assessment

- Get Income Tax estimates

- Check VAT for errors

- Submit VAT to HMRC

- Calculate and submit CIS

- Employee & project management

- Track employee time

- See project profitability

- Set budgets

- Further information

Introduction to QuickBooks Online

Sage Accounting Plus Features

- Create and send invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Be Making Tax Digital Ready for VAT

- Supports unlimited users

- Manage and submit CIS

- Run advanced reports

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

- Invoice in multiple currencies

- Submit Tax to HMRC

- Manage inventory

- Pay your people

- Share information with your accountant

- Further information

Sage Accounting (UK) - Introduction

What are the Differences Between QuickBooks and Sage 50

Both QuickBooks and Sage 50 have large user bases, with Sage 50 having over 400,000 businesses using the software in the UK. Both software systems offer core accounting features for small businesses and SMB’s.

We have already covered the features available in QuickBooks Plus when we compared it to Sage Accounting. Sage 50 is the next product up from Sage Accounting and has many more features, including advanced inventory management and integration with other Sage 50 modules, such as Payroll.

Sage 50 is available in two different versions, Professional and Standard.

Sage 50 Professional Features

- Manage cash flow, income, expenses and payments

- Create professional personalised invoices and quotes

- Access finance data 24/7 via an internet connection

- Set up contacts with individual pricing and discounts

- Create sales and purchase orders

- Set up invoices, transactions, sales and purchase orders to recur

- Automatic bank reconciliation (including foreign currencies)

- Calculate and submit VAT to HMRC

- Add extra users (additional fees apply)

- Manage and submit CIS to HMRC (additional fees apply)

- Create and run bespoke reports

- Sage 50 Payroll Integration

- CRM Integration with Sage CRM

- Advanced stock management

- Manage multiple companies, departments and budgets incl. management reports

- Invoice & trade in foreign currencies

- MTD compliant

- Pay now button with integration with Stripe, PayPal

- GoCardless integration

Both QuickBooks and Sage 50 can be further enhanced by adding extra modules or apps. There are a wide range of apps available for QuickBooks, Sage 50 can be further enhanced by adding extra modules from the Sage 50 suite of products or adding apps from the Sage marketplace.

QuickBooks and Sage 50 are easy to navigate, intuitive and are well proven and established finance and accounting systems for the Cloud.

Sage 50 Overview

QuickBooks vs Sage 200 Comparison

The next accounts package up from Sage 50 is Sage 200, which is targeted to SMB’s and medium sized businesses. Sage 200 can be used in the Cloud and there are two versions, Standard and Professional, see comparison.

When compared to QuickBooks Online, Sage 200 is a powerful finance management and ERP solution and has more advanced features, it is highly configurable and can manage more complex accounting requirements and processes.

Sage 200 enables you to add extra modules as your company grows, such as project accounting, manufacturing, BOM and supply chain management, see the list of features for Sage 200.

Frequently Asked Questions

QuickBooks is often better for small businesses focusing on accounting due to its user-friendly interface and integration capabilities. Sage 50 is ideal for businesses needing broader functionality, including inventory and project management. Assess your business needs to choose the right software, and consider consulting an accountant for personalised advice.

QuickBooks is best for small businesses or sole traders seeking streamlined accounting features, while Sage offers comprehensive solutions suitable for businesses of all sizes with broader operational needs. The choice depends on your business requirements; consulting an accountant can provide tailored advice to help select the right software.

Sage 200 Overview

Sage Intacct versus QuickBooks

The Sage Intacct Cloud solution is one of the most versatile and feature rich Cloud finance management solutions available, primarily targeted towards medium sized business, whereas QuickBooks is targeted to smaller businesses.

Medium sized businesses tend to have more complex requirements and Intacct tackles these requirements with its modular approach.

Sage Intacct has won many awards and has scored the highest for best core financials software for 5 years running, for more information on Sage Intacct and its features.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

National distributor L W Cole powers up data insights with Sage Intacct

What Types of Businesses Use Sage and QuickBooks?

When people think about Sage and QuickBooks they normally associate both companies as leading accounting software providers for small businesses, this is true for software packages such as QuickBooks Online (Start, Essentials and Plus), Sage Accounting (Start, Standard and Plus, formerly known as Sage One), and Sage 50.

Small Business Industry Sectors using Sage and QuickBooks:

- Self Employed

- Start Ups

- Small retailers and food shops

- Small online retailers

- Construction

- Not for Profits

- Wholesalers

- Accounting and Bookkeepers

- Professional services

- In fact, most business industry sectors use both systems

When you focus on accounting software for larger SMB’s, medium sized business and larger companies in the UK Sage has a broader product range for Cloud accounting solutions, business users include all types of industry sectors including manufacturing, high tech, wholesale, finance and distribution and many more industries, further information.

How to Decide If Sage or QuickBooks is Best for Your Business?

The first decision that many businesses make when choosing the right accounting system is the delivery model, i.e will the software run in the Cloud, be hosted or used as on-premise. Many businesses that are considering a new accounting software solution are moving to the Cloud.

Both QuickBooks and Sage have software packages that work in the Cloud. For smaller companies the list of questions to ask yourself when choosing a new accounts system is pretty straightforward, see QuickBooks guide, and Sage guide.

Buyers Guide to Selecting an Accounting Solution Download

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss Sage or to organise a meeting, consultation call, demonstration or personalised quote.

Other areas to consider when deciding if either Sage or QuickBooks is right for your business:

- Make a list of your business requirements and features that you require

- Identify top priorities and challenges in your business

- Decide on what available budget you have

- Organise a Demo or trial from your short list of accounting packages

- Is the accounting software easy to use?

- Does your accounts team need to work outside the office?

- Does your business need to accelerate financial processes—without increasing headcount or IT budget?

- Do you need to integrate accounts with other systems, such as CRM?

- Do managers want or need self-service access to their relevant KPIs?

- Does your organisation struggle with inefficient processes?

- Review sites like Trustpilot for Sage and Quickbooks

- Check references and customer video testimonials

What are the Benefits of Using Sage or Quickbooks in the Cloud?

There has been a big shift away from using on-premise accounting software towards using packages such as Sage or QuickBooks in the Cloud, the main benefits of using accounts and finance software in the Cloud are, work from anywhere with internet connection, real time access to accounts data and reduce IT costs and overheads.

Benefits of Cloud accounting software such as Quickbooks and Sage

- Finance and Accounts data is accessible 24/7

- Spread the cost by paying monthly (SaaS)

- See your current financial position in real time and at any time

- All accounting information is in one place

- Work from anywhere with Internet connection

- Both QuickBooks and Sage support access through mobile devices with a connection to the internet

- Frees up IT resources and reduces expensive IT overheads

- The software is constantly updated with new versions so you do not need to worry about applying software updates

- Real time dashboards and reporting enables you to monitor key performance indicators for your business

- Hosting Sage or QuickBooks in the Cloud provides a very high level of security, the software is hosted on a secure server where you have protection against financial and accounting data loss

- No need to invest in expensive servers or data backup hardware

- Quickly give access to multiple users and set employee permissions

- Easily collaborate with your accountant and other users in your business

Contact AlphaLogix to Discuss Which Cloud Accounting System is Best for Your Business

Our experts will help you discover which Accounts and Finance Management software is best suited for your business based on your requirements, business size and industry type.

We will provide you with a free initial consultation call, and we can also provide you with a free demonstration on certain products.

Call us today on 0330 043 0140 to organise a demo or to speak with one of our experts, alternatively email us at info@alphalogix.co.uk. We will help you through every step of the selection process, implementation process, including training and support.

Related Information