What is Sage Accounting?

Sage Accounting is the market leading accounts and finance software for small businesses, start-ups and sole traders, it is used in accounting to manage tasks like bookkeeping, invoicing, expenses, cash flow, bank reconciliation, inventory, and managing multi-currencies. Sage Accounting (previously known as Sage One) also helps generate financial reports, manage payroll, and submit tax returns online, ensuring businesses remain tax compliant and efficiently handle employee-related financial tasks.

The Sage Accounting software is simple to use and is accessed online via the Cloud. Sage Accounting is available in three different versions, Sage Accounting Start, Sage Accounting Standard and the more advanced version Sage Accounting Plus. Sage Accounting is hosted in the Cloud by Sage, so you do not need to install the software onto your own computer. New software updates are automatically applied by Sage, so you are always using the latest version.

One of the key strengths of Sage Accounting is that it integrates seamlessly with other Sage software modules, such as Payroll and popular addons such as AutoEntry, this brings you all the advantages of a streamlined and fully co-ordinated business. The software can be further enhanced by adding software apps from Sage marketplace.

What are Sage Accounting Key Features?

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Be Making Tax Digital Ready for VAT and HMRC

- Calculate and submit VAT online

- Forecast cash flow

- Manage purchase invoices

- Record expenses and snap receipts with AutoEntry

- Run detailed financial reports

- Manage and submit CIS

- Pay staff and manage Payroll

- Send quotes and estimates

- Built in GDPR compliance

- Unlimited users (with the Accounting Plus version)

Guides and Related Information

Download the Sage accounting brochure and product guide Comparison of Sage 50 and Sage Accounting (previously known as Sage One) – PDF

Getting Started with Sage One Accounting – Download PDF

Buyers Guide to Selecting an Accounting Software Solution Download

Sage Accounting vs Sage 50

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss your Accounting and Finance software requirements, or to book a free consultation call, meeting or demonstration.

Request a Call Back to discuss the range of Sage Finance and Accounting Products

• Request a Free Consultation call or Meeting

• Organise a software demonstration

• Request Pricing or Organise a Quote

Sage Accounting - An Intro to Sage Accounting

What is Sage Accounting Used for?

Sage Accounting is used in finance to help solopreneurs, start-ups and small businesses manage their financial tasks. It allows users to send invoices, track expenses, and reconcile payments efficiently, providing a simple and effective solution for basic accounting needs.

What does Sage Accounting do?

- Sage Accounting enables you to easily manage your cash flow, invoicing and purchase invoices

- Quickly see what you’re owed, manage late payments, and schedule supplier payments.

- Track expenses and receipts using the Sage accounting AutoEntry module

- Speed up processing using the automated bank reconciliation feature in Sage Accounting

- Create and send personalised invoices, and give your business documents a professional edge

- Manage purchase invoices

- Sage Accounting software allows for simple, powerful VAT management

- Send quotes and estimates

- Manage and Submit CIS (Construction Industry Scheme)

- Quickly and easily calculate VAT

- Reconcile to only pay what you owe with Sage Accounting

- Automatically file returns securely online with HMRC

What is Sage Accounting?

Why Use Sage Accounting?

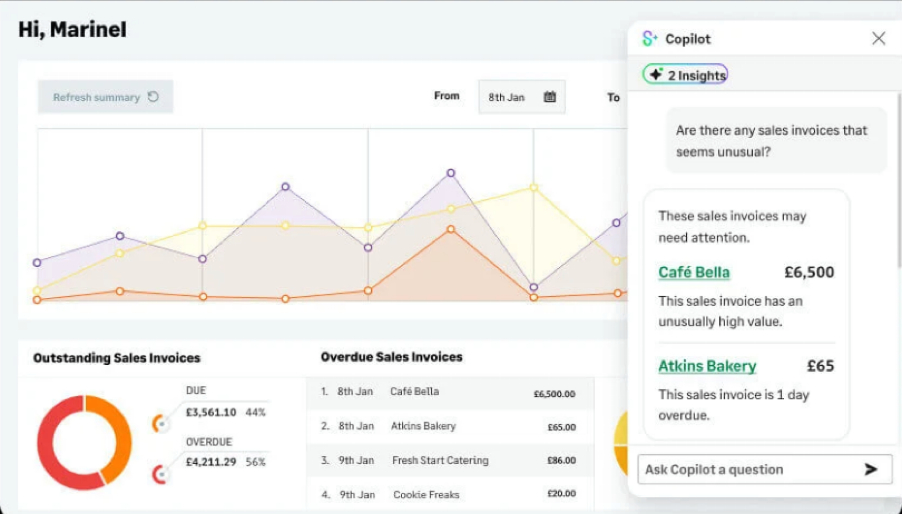

Sage accounting offers benefits such as real-time visibility into your finances, reports on transactions, and financial insights from dashboards. It helps you manage cash flow, plan for future income and expenses, and efficiently track and categorise transactions, ensuring your financial data is organised and accessible.

Benefits of using Sage Accounting

- See your current financial position at any time

- Everything is in one place

- Work from anywhere with Internet connection

- Great value for money and you can spread the cost by paying monthly

- Frees up IT resources and reduces expensive IT overheads

- The solution requires nothing to install and is constantly updated by Sage who apply the latest software updates

- Real time financial data is available 24/7

- Manage payroll and employee payslips

- Sage accounting security is world class and is hosted at one of many Datacentres where you have protection against financial and accounts data loss

- No need to invest in expensive servers or data backup hardware

- Easily collaborate with your accountant and other Sage accounting users in your business

- Easily submit VAT returns online and is making tax digital compliant (MTD)

- Easily create sales invoices and purchase orders

Sage Accounting: Start Invoicing

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss your Accounting and Finance software requirements, or to book a free consultation call, meeting or demonstration.

Request a Call Back to discuss the range of Sage Finance and Accounting Products

• Request a Free Consultation call or Meeting

• Organise a software demonstration

• Request Pricing or Organise a Quote

What are the Features in Sage Accounting?

Sage Accounting at a glance

Easy cloud-based financial software for small businesses with 1 to 49 employees.

- Get paid quicker with trackable invoices.

- Automate admin with AI-powered data capture.

- Stay compliant with correct VAT calculations.

Choose from 3 plans and versions with the option to add Sage Payroll.

- Sage Accounting Start– ideal for sole traders with a maximum of 1 user.

- Sage Accounting Standard– has all the features of Start but has more features such as quotes and estimates and purchase invoices.

- Sage Accounting Plus– the most comprehensive version with features such as multi-currency and inventory.

The 3 versions of Sage Accounting all have different levels of features and software functionality, the entry level version is Sage Accounting Start, Sage Accounting Standard is the most popular and the most advanced version is the Sage Accounting Plus version.

Features of Sage Accounting Start

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Be Making Tax Digital Ready for VAT

- Supports one user

Features of Sage Accounting Standard

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Be Making Tax Digital Ready for VAT

- Supports unlimited users

- Manage and submit CIS

- Run advanced reports

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

Features in Sage Accounting Plus

- Create and send sales invoices

- Track what you’re owed

- Automatic bank reconciliation

- Calculate and submit VAT

- Be Making Tax Digital Ready for VAT

- Supports unlimited users

- Manage and submit CIS

- Run advanced reports

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

- Multi-currency banking and invoicing

- Manage inventory

All three versions of Sage accounting are Making Tax Digital (MTD) compliant.

Sage Accounting: Enter expenses

Frequently Asked Questions (FAQ’s)

Sage software is an accounts system the allows small business owners to manage accounting, invoicing, expenses, cash flow, bank reconciliation, inventory, multi-currencies, quotes and financials reporting as well as enabling you to submit tax returns online and be tax compliant, Sage also helps you to manage employee payroll.

Yes, Sage is a UK company. It is a British multinational enterprise software company headquartered in Newcastle upon Tyne, England.

Sage accounting can be easy to learn with the right support and resources. Your prior experience with accounting concepts will influence the learning curve. Comprehensive courses and certifications can significantly simplify the process, making Sage Accounting accessible even for beginners.

Choose Sage Accounting for its reliable cloud-based platform, ease of use, accounting functionality, and is a HMRC recognised solution. Sage offers unique features that ensure peace of mind and confidence in managing your finances securely.

Alternatives to Sage Accounting include Sage 50, Sage 200 and Sage Intacct, which offer more advanced accounting features and better scalability for growing businesses. These options provide enhanced functionality, integration capabilities, and comprehensive financial management tools tailored to meet more complex accounting needs.

The 3 alternatives (Sage 50, Sage Intacct and Sage 200) to Sage accounting are ideal for:

- Fast growing businesses that need a system that grows with them

- Companies who are outgrowing Sage Accounting or Sage One

- Companies who need a system that is tailorable

- Companies who need to manage their inventory and supply chain better

- Businesses that require flexible accounting periods

- Companies who deal with multi-currencies or have multi-locations

- Businesses with a large amount of financial transactions

Related Information

Sage Accounting vs Sage Intacct

To discuss the range of Sage finance and accounting products for Small to Medium sized businesses contact us on 0330 043 0140 or email us at info@alphalogix.co.uk

Sage Accounting, formerly Sage One, offers all you need to manage your accounts and finances for small businesses, sole traders and start-ups.

No, Sage 50 and Sage Accounting are not the same. Sage Accounting (previously known as Sage One) can only be used online via the cloud whilst Sage 50 can be used as on-premise software or accessed via the cloud. Sage 50 offers more advanced features and flexibility, while Sage Accounting provides basic, easy-to-use accounting tools, but it costs less than Sage 50.

Related information

Sage Accounting (previously known as Sage One) is a cloud-based accounting software that requires no installation. It always runs the latest version, ensuring you and your clients have up-to-date features. You can access Sage Accounting from anywhere with internet access and a compatible browser, making it highly convenient and flexible.

Sage Accounting subscription licence costs begin at £15 per month (excluding VAT) for Sage Accounting Start edition and from £39 per month (excluding VAT) for Sage Accounting Plus edition. The cost of Sage Accounting is based on a subscription only pricing plan (SaaS), where fees are paid on a monthly basis, for the latest pricing go to Sage’s pricing page.

No, Sage Accounting does not include payroll by default. However, you can add payroll management as an optional feature. This allows you to auto-sync payroll data seamlessly into Sage Accounting for efficient financial management.

Sage Accounting is aimed at sole traders, start-ups and small businesses across a wide range of industries, it is widely used in the following business sectors;

- Agriculture

- Automotive

- Construction

- Creative

- E-commerce

- Finance

- Handymen

- Healthcare

- Hospitality

- Legal

- Manufacturing

- Non-profit

- Property

- Retail

- Self employed

- Transport

Sage Business Cloud Accounting Start - Bank reconciliation

What are the Advantages and Disadvantages of Sage Accounting

Advantages of Sage Accounting software

- Easy to use and intuitive

- Offers simple cloud accounting core functionality

- Good value and pay monthly

- Easy to learn with the minimum amount of training needed

- Ideal for small business owners, sole traders and the self employed

Disadvantages of Sage Accounting software

- Lacks advanced accounting features

- Not very flexibly and tailorable

- Cannot automate complex accounting processes

- Does not work well in larger SMB companies or medium sized businesses

- Does not adapt well for fast growing businesses who need an accounting system that adapts as they grow

Sage Accounting Spotlight – Customise Invoice Layouts

Why Choose AlphaLogix as your Sage Business Partner?

Founded in 1995, AlphaLogix is one of the largest and most established Sage business partners in the UK, our accounting experts are all fully accredited for Sage accounting and finance software solutions and can help you with your accounting software requirements.

We provide a wide range of Sage professional services for businesses including consulting, helping you to choose the best Sage solution, software setup, installation, configuration, report design, integration, data migration, upgrades, add-on apps and bespoke training courses, our Sage Services include:

- Sage implementation

- Software Configuration

- Sage Consultancy

- Report and dashboard design service

- Sage training

- Sage accounts layout services

- Data repairs and data migration services

- Integration with other business applications

- Sage hosting

- Installation and setup of add-on apps from Sage marketplace

- Website integration

- Sage e-commerce and Amazon integration

- Help desk and technical support

- Sage payroll setup and integration

What do our Sage customers say?

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss your Accounting and Finance software requirements, or to book a free consultation call, meeting or demonstration.

Request a Call Back to discuss the range of Sage Finance and Accounting Products

• Request a Free Consultation call or Meeting

• Organise a software demonstration

• Request Pricing or Organise a Quote