What is Sage Payroll?

Sage Payroll is a cloud-based payroll software with HR features that helps small to medium sized businesses with 1 to 150 employees manage their payroll and pay employees. Sage Payroll automates payroll processes, manages payslips, filing pensions, P60’s, expenses, statuary pay, holidays and is a HMRC recognised payroll solution.

The Sage Payroll software enables employees to view their latest payslips and P60’s online using a self-service option.

Sage Payroll software is hosted in the cloud and is available online so you can manage your Payroll from any location with internet connection 24/7. Sage Payroll and HR software is a subscription licence which is paid monthly, software updates are applied automatically by Sage which will keep you on the latest version and is compliant with the latest pension’s and payroll legislation.

One of the key strengths of Sage Payroll is its tight integration with Sage’s accounting and finance management solutions such as Sage 50 Accounts, Sage Accounting and Sage 200.

What are the features of Sage Payroll?

- Process weekly, bi-weekly, and monthly payrolls, helping you pay staff quickly and efficiently.

- Employees can securely view their payslips and P60s online, anywhere.

- Manage payroll for up to 150 employees.

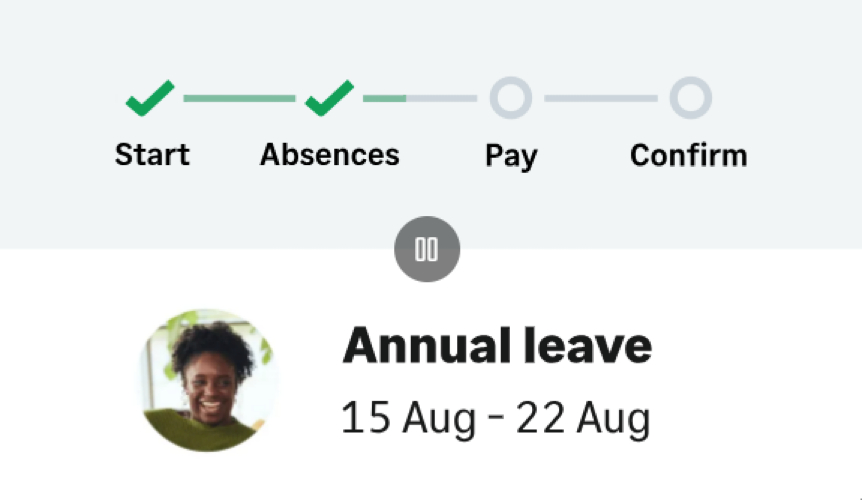

- HR that supports Payroll, Track and manage employee leave for accurate payroll data and reporting.

- Manage Pensions faster, Sage Payroll manages workplace pension schemes such as NEST, Now and People’s Pension or choose your own provider.

- Sage Payroll is a HMRC recognised solution.

- Sage Payroll helps you comply with the very latest legislation for the tax year.

- Payroll integration with Sage Accounting, Sage One, Sage 200 payroll, Sage Intacct and Sage 50.

- You and your employees can access Sage Payroll via mobile app for quick and easy updates.

Guides and Related Information

Download Sage 50 Payroll Product Guide PDF

Sage 50 Payroll

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss your Sage Payroll requirements or payroll integration, or to book a free consultation call, meeting or demonstration.

Sage Payroll (UK) - Getting Started

What is Sage Payroll Used for?

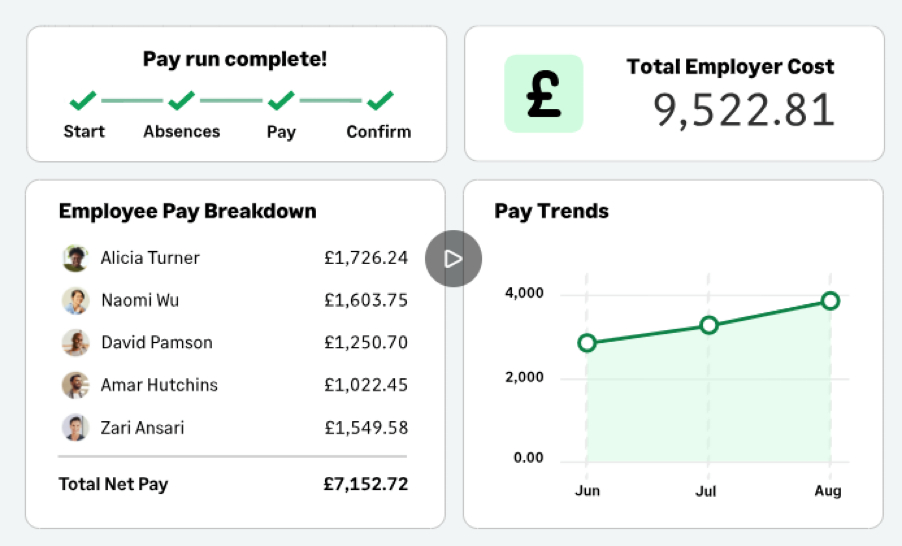

Sage Payroll manages your payroll processes such as generating payslips, payment summaries, pensions, statuary pay, tax calculations, creating P60’s, tracking absences and holidays as well as online payroll submissions to HMRC. Sage Payroll gives you a greater insight into employee costs and makes management easy.

Advantages and Benefits of Sage Payroll

The advantages of Sage Payroll software are that it automates payroll calculations, deductions, and generates accurate payslips. This efficiency saves time, reduces errors, and simplifies the processing of bonuses, expenses, and holiday pay, making payroll management more manageable and accurate for businesses.

- Easy-to-use and intuitive, as it takes you through the payroll process step by step.

- Always supported and the latest software updates are automatically applied.

- Complete control of your payroll processes and submissions to HMRC.

- Accessible anytime and anywhere with internet connection.

- Automates tasks and increases user productivity.

Sage Payroll Online Payslips

Why Use Sage Payroll?

Sage Payroll enables small to medium sized businesses from 1 employee up to 150 employees to improve their payroll processes. Businesses use Sage payroll for a variety of benefits and productivity improvements including:

- Manage your payroll

- Print or email payslips to employees

- Annual consolidated reporting

- Employees can view their payslips online

- HMRC compliant

- Pay your employees accurately

- Analyse your payroll

- Legislation made simple

- File pensions faster

- Payroll calculation

- Manage holidays and absences

- Real time reporting

- Rule out human error

- Easy to use and intuitive

- Automate payments and banking

Sage Payroll: Process year end

Sage Payroll Features

Sage Payroll is available in 3 different versions, the entry level version is Payroll Essentials which enables you to pay employees and do essential HR admin. Sage Payroll Standard is more powerful and helps you manage payroll, people and mobile expenses, and the most advanced version is Payroll Premium with Payroll with advanced HR like tracking hours.

Sage Payroll Essentials Features

- 5 employees.

- Complete a pay run in 4 simple steps

- Employees self-serve payslips and P60s

- HMRC real time information

- Automatic pension enrolment

- Employee records and essential HR tasks

- Track and manage employee holidays

Sage Payroll Standard Features

Everything from Payroll Essentials and:

- 5 employees. Add more users

- Personalised portal for onboarding

- Build your company’s org chart

- Automate approval workflows and actions

- Track all leave and absence types

- Submit and approve employee expenses over mobile

Sage Payroll Premium Features

Everything from Payroll Standard and:

- 5 employees. Add more

- Manage timesheets and overtime online

- Log time per project or per day

- Run reports to see timesheet status

- Manage shifts in schedule planning

- Shift scheduling made easy

Sage Payroll Frequently Asked Questions (FAQ’s)

Yes, to reprint a P60 in Sage 50 Payroll, login to the software, go to the Employee list and select the employees that you would like to print a P60 for. Select Reports and next to Year End, click the chevron >. Then select the year for the P60 you want, select the relevant P60 report then choose Print. You can also email P60’s from Sage 50 Payroll.

Yes, you can use Sage for payroll. Sage offers HMRC-recognised payroll software that helps automate payroll processes, ensuring accurate and timely payments. It’s ideal for small and medium-sized businesses looking to save time and improve payroll management. Sage payroll integrates with popular accounting systems like Sage 50, Sage Accounting and Sage 200.

Yes, Sage offers a payroll service called Sage Payroll Full Service, which provides comprehensive payroll, HR, and time management solutions to support growing businesses.

Sage Payroll is HMRC-recognised software designed to automate payroll processes for small and medium-sized businesses from 1 to 150 employees. It ensures accurate and timely payments to employees, helping businesses save time and reduce errors in payroll management.

Sage Intacct integrates with ADP for its payroll capabilities, allowing users to combine accounting, payroll, and HR functions for improved efficiency and insights. This integration helps streamline processes and enhance profitability, providing a comprehensive solution without a standalone payroll module.

Yes, you can print or reprint a P45 in Sage 50 Payroll, see instructions.

Sage 50 Accounts integrates with a wide range of Sage products and Sage services as well as seamless Office 365 integration.

- Sage Pay (now Opayo)

- Sage CRM

- Sage 50 P11D

- Sage Salary and Employee Payments

- Sage CIS Module

- Sage 50 Payroll

- Sage Pensions Module

- Sage 50 Manufacturing

- Sage 50 HR

- Microsoft Office 365 Sage 50 Integration

Advantages and Weaknesses of Sage Payroll.

Advantages of Sage Payroll

- Intuitive and easy to use

- Affordable monthly subscription costs

- Choose from 3 different versions, Essentials, Standard or Premium

- Great choice for growing small and medium sized businesses with up to 150 employees

- Manage payroll online via the cloud, so you can access Sage Payroll from anywhere with internet connection 24/7

- Run payroll in 4 easy steps

- HR features

Disadvantages of Sage Payroll

- Not suitable for larger companies over 150 employees

- Limited number of advanced features for more complex requirements or for larger companies.

Sage 50 Payroll (UK) - Get your payroll done

Contact AlphaLogix – Sage Payroll Business Partner in the UK

AlphaLogix was founded in 1995 and today we are a leading tier 1 strategic Sage Business partner in the UK. Our Sage Payroll consultants have successfully implemented hundreds of Sage sites across the UK and help companies with their Payroll processes.

All of our Sage Payroll consultants are certified by Sage and we pride ourselves in providing outstanding customer service and help desk support, with quick resolutions to technical queries. AlphaLogix can setup your payroll system or integrate it with your accounting system such as Sage 50, Sage 200 or Sage Intacct.

Contact us on 0330 043 0140 or email us at info@alphalogix.co.uk to discuss your Sage Payroll requirements or payroll integration, or to book a free consultation call, meeting or demonstration.

We have offices, consultants and Sage customers throughout the whole of the UK.